Description

Budget Excel Spreadsheet and Expense Tracker: Your All-in-One Financial Planning Solution

Take the stress out of managing your family’s finances with the Family Budget and Expense Tracker, a comprehensive Excel-based tool designed to empower households with clear, actionable insights into their income, expenses, savings, and investments. Tailored for families of all sizes, this spreadsheet simplifies budgeting by organizing your financial data into an intuitive, visually engaging format.

With features that allow you to track multiple income streams, categorize expenses, monitor bank accounts, and set savings and investment goals, the Family Budget and Expense Tracker is your partner in achieving financial stability and building a secure future. From monthly budgeting to annual financial reviews, this tool provides everything you need to make informed decisions and stay in control of your money.

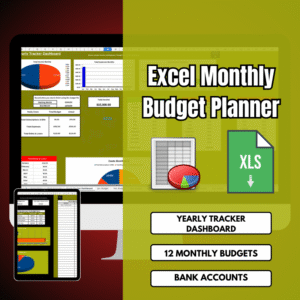

The Family Budget and Expense Tracker includes three powerful spreadsheets: Yearly Tracker Dashboard, Bank Accounts, and 12 Monthly Budgets. These sheets work together to provide a holistic view of your family’s finances, with automated calculations and dynamic visualizations like Pie Graphs and Bar Graphs to make data analysis effortless. Whether you’re saving for a family vacation, paying down debt, or planning for long-term investments, this Excel file offers the flexibility and depth to meet your needs.

Yearly Tracker Dashboard: A Comprehensive Financial Snapshot ✅

The Yearly Tracker Dashboard is the cornerstone of the Budget Excel Spreadsheet, offering a high-level overview of your financial performance across the calendar year. This spreadsheet aggregates data from all 12 months, displaying total income streams and actual costs across key categories: Expenses (e.g., groceries, transportation), Subscriptions & Bills (e.g., utilities, streaming services), Debt & Loan Payments (e.g., mortgage, credit cards), Savings Targets, and Investment Goals.

The dashboard uses Pie Graphs to illustrate the proportion of your budget allocated to each category—for instance, showing that 30% of your spending goes to Expenses or 15% to Savings. Bar Graphs compare monthly income against expenses, highlighting trends like seasonal spending spikes or surplus income available for investments. These visualizations make it easy to identify areas for cost-cutting or reallocation, empowering you to make strategic budgeting decisions that align with your family’s goals.

Bank Accounts: Stay on Top of Your Cash Flow ✅

The Bank Accounts spreadsheet is designed to keep your family’s liquidity in check by tracking Checking and Savings account balances. You can record total deposits (e.g., salaries, bonuses) and withdrawals (e.g., bill payments, large purchases) for multiple accounts, ensuring an accurate, real-time view of your cash flow.

The spreadsheet uses simple formulas like Current Balance = Previous Balance + Deposits – Withdrawals to automate calculations, saving you time and reducing errors. Bar Graphs visualize monthly account activity, helping you spot patterns, such as increased withdrawals during holiday seasons. This sheet is invaluable for ensuring your checking account covers monthly expenses while your savings account grows toward your financial goals.

12 Monthly Budgets: Detailed Planning for Every Month ✅

The 12 Monthly Budgets spreadsheets provide a dedicated sheet for each month, making it easy to plan and track your family’s finances with precision. Each sheet allows you to record multiple income streams (e.g., primary income, side hustles, dividends) and set budgets for Expenses, Subscriptions & Bills, Debt & Loan Payments, Savings Targets, and Investment Goals.

Automated calculations, such as Remaining Budget = Budgeted Amount – Actual Spending, highlight surpluses or deficits in real time. Each monthly sheet includes Pie Graphs to show the breakdown of spending by category and Bar Graphs to compare income versus expenses, helping you adjust spending habits to meet your savings or investment targets. The inclusion of Savings Targets and Investment Goals ensures you’re not just managing expenses but also planning for future milestones, like a child’s education or retirement.

Visualizing Your Financial Journey

The Budget Excel Spreadsheet leverages Excel’s charting capabilities to transform raw data into actionable insights. Pie Graphs in the Yearly Tracker Dashboard and 12 Monthly Budgets illustrate how your budget is distributed across categories, making it easy to see, for example, that 25% of your income goes to Debt & Loan Payments or 10% to Investments.

Bar Graphs provide a clear comparison of income and expenses, both monthly and annually, helping you identify trends like overspending on subscriptions or opportunities to increase savings contributions. These visualizations simplify complex financial data, making it accessible for all family members to understand and engage with the budgeting process.

Purchasing and Using the Family Budget and Expense Tracker 📌

- Purchase: Visit Jadesales.shop and locate the Family Budget and Expense Tracker listing. Add it to your cart and complete the secure checkout process.

- Download: After purchase, you’ll be redirected to a download page where you can access the zip file containing the Excel file.

- Unpackage: Save the zip file to your computer, extract its contents, and open the Excel file in Microsoft Excel or a compatible program like Google Sheets.

- Input Financial Data: Start by entering your family’s income streams, budget limits, and expense categories in the 12 Monthly Budgets sheets. In the Bank Accounts sheet, log your Checking and Savings account details, including deposits and withdrawals.

- Track and Analyze: Regularly update your income, expenses, savings, and investment contributions throughout the year. Use the Pie Graphs and Bar Graphs to monitor trends, identify overspending, and ensure you’re meeting your savings and investment goals.

Why the Family Budget and Expense Tracker Stands Out 📌

The Family Budget and Expense Tracker is more than a budgeting tool—it’s a comprehensive financial management system designed with families in mind. Its intuitive interface makes it approachable for users of all skill levels. While its robust features cater to complex financial needs.

The inclusion of Savings Targets and Investment Goals sets this spreadsheet apart, encouraging families to not only manage day-to-day expenses. But also plan for long-term financial security, such as funding a child’s college education, building an emergency fund, or investing for retirement. The automated calculations eliminate manual errors, and the dynamic graphs provide instant clarity, saving you time and effort.

This tool is versatile enough to accommodate diverse family structures and financial situations. Whether you’re managing a single-income household, balancing multiple income streams, or coordinating budgets for a large family, the Family Budget and Expense Tracker adapts to your needs.

The ability to track Checking and Savings accounts ensures you maintain liquidity for daily expenses while growing your wealth through savings and investments. The 12 Monthly Budgets allow for granular control, letting you adjust budgets monthly to account for changing circumstances, like holiday spending or unexpected repairs.

Moreover, the visual appeal of the Pie Graphs and Bar Graphs makes financial discussions more engaging for the whole family. By involving everyone in the budgeting process, you can foster financial literacy and collective accountability, turning budgeting into a shared family goal. The spreadsheet’s flexibility also allows you to customize categories or add notes, ensuring it aligns perfectly with your unique financial priorities.

Take Control of Your Family’s Finances Today

The Family Budget and Expense Tracker is your key to financial clarity and confidence. By providing a structured yet flexible framework for managing income, expenses, savings, and investments, it helps you build a solid foundation for your family’s future.

Whether you’re aiming to pay off debt faster, save for a dream home, or grow your investment portfolio, this tool equips you with the insights and organization needed to succeed. Its user-friendly design and powerful features make it an essential resource for any household looking to achieve financial freedom.

📄 TERMS & CONDITIONS

1. This digital product offers instant download; we don’t ship physical items.

2. The instant download arrives as an Excel spreadsheet file.

3. Listing photos serve for display only and don’t appear in your download.

⚠️ RETURNS: Digital files don’t allow returns or exchanges. For further information, please ask all questions before you buy.

⚠️ DISCLAIMER 1: These templates showcase the creator’s artistic inspiration.

⚠️ DISCLAIMER 2: Use this Excel file for personal or business purposes only; don’t sell or share it. We don’t grant exclusive rights. File sharing, distribution, or commercial use by anyone other than the purchaser violates the rules.

❓ QUESTIONS?

If you have any questions, send me a message! I’m always happy to assist 🙂

Grow your online search with the following products

Digital Studio Store | Get Started Organizing Your Life Today

Build Your Financial Picture with Accuracy | Financial Planners

Find the Best Social Media Template | Customizable Templates

Discover more Digital Listings from my Pinterest Board

Reviews

There are no reviews yet.